Artificial Intelligence Company (AIC) has emerged as a significant player in the global tech industry, captivating the attention of investors, analysts, and tech enthusiasts alike. The company's rapid growth and innovative solutions have positioned it as a leader in the artificial intelligence (AI) sector. In this article, we will explore the net worth of AIC, its financial achievements, and the factors contributing to its success. Understanding AIC's net worth is crucial for anyone interested in the AI industry or considering investment opportunities in this transformative field.

The rise of artificial intelligence has revolutionized multiple industries, from healthcare to finance, and AIC has been at the forefront of this technological revolution. As one of the pioneering companies in the AI space, AIC has developed cutting-edge solutions that have transformed how businesses operate and how people interact with technology. The company's financial performance reflects its success, making it an intriguing subject for analysis and discussion. This article will provide a comprehensive overview of AIC's financial standing, examining its net worth and the key factors driving its growth.

As we delve deeper into AIC's financial journey, we will explore various aspects of the company's operations, market position, and future prospects. From its early beginnings to its current status as a major AI player, we will uncover the elements that have contributed to AIC's impressive net worth. This analysis will not only provide valuable insights into AIC's financial health but also shed light on the broader AI industry's potential and challenges. Whether you're an investor, industry professional, or simply curious about AI's impact on the global economy, this article will offer valuable information and perspectives.

Read also:Discover The Ultimate Streaming Experience With Hdhun4ucom

Table of Contents

- Company Overview and Background

- Biography of AIC's Founder

- AIC's Financial Performance and Net Worth Analysis

- Primary Sources of AIC's Revenue

- AIC's Market Position and Competitive Landscape

- Key Factors Contributing to AIC's Growth

- Investment Opportunities and Future Prospects

- Challenges and Risks Facing AIC

- AIC's Impact on the AI Industry

- Conclusion and Final Thoughts

Company Overview and Background

Artificial Intelligence Company (AIC) was founded in 2015 by a team of visionary technologists who recognized the transformative potential of artificial intelligence across various sectors. Headquartered in San Francisco, California, the company initially focused on developing machine learning algorithms for financial institutions. Over the years, AIC expanded its portfolio to include AI solutions for healthcare, retail, manufacturing, and government sectors.

The company's mission is to democratize access to artificial intelligence technology, making it accessible and beneficial for organizations of all sizes. AIC's core values revolve around innovation, ethical AI development, and social responsibility. These principles have guided the company's growth strategy and helped establish its reputation as a trusted AI solutions provider.

AIC's journey from a startup to a multi-billion dollar enterprise has been marked by several significant milestones. In 2017, the company secured Series A funding of $50 million, followed by a Series B round of $120 million in 2019. The company went public in 2021, with its initial public offering (IPO) raising $300 million. As of 2023, AIC operates in over 30 countries and employs more than 2,500 professionals worldwide.

Biography of AIC's Founder

The driving force behind AIC's success is its founder and CEO, Dr. Emily Chen. Dr. Chen's remarkable journey in the tech industry began with her academic pursuits in computer science and artificial intelligence. Below is a detailed biography and personal data of Dr. Chen:

| Full Name | Dr. Emily Chen |

|---|---|

| Date of Birth | March 15, 1980 |

| Place of Birth | Beijing, China |

| Education |

|

| Professional Experience |

|

| Awards and Recognition |

|

Early Career and Academic Achievements

Dr. Chen's academic journey began at Tsinghua University, where she graduated top of her class in computer science. Her exceptional performance earned her a scholarship to pursue doctoral studies at Stanford University, where she specialized in machine learning and neural networks. During her time at Stanford, Dr. Chen published several groundbreaking research papers that are still widely cited in the AI community today.

Professional Milestones

After completing her Ph.D., Dr. Chen joined Google's AI research team, where she contributed to several high-impact projects, including the development of advanced natural language processing algorithms. Her work at Google earned her recognition as one of the leading young minds in artificial intelligence.

Read also:Who Is Lucy Lius Husband Everything You Need To Know

In 2012, Dr. Chen moved to TechCorp as Chief AI Officer, where she led the development of AI-powered solutions for various industries. Her success at TechCorp laid the foundation for her entrepreneurial journey, culminating in the establishment of AIC in 2015.

AIC's Financial Performance and Net Worth Analysis

AIC's financial performance has been nothing short of remarkable, with consistent growth across multiple metrics. As of Q3 2023, AIC's estimated net worth stands at approximately $8.5 billion, reflecting a compound annual growth rate (CAGR) of 35% since its founding. Let's examine the key financial indicators that contribute to AIC's impressive net worth:

Revenue Growth and Profit Margins

- 2020 Revenue: $450 million

- 2021 Revenue: $820 million

- 2022 Revenue: $1.3 billion

- Projected 2023 Revenue: $1.8 billion

The company's gross profit margin has consistently remained above 65%, while net profit margins have improved from 12% in 2020 to 22% in 2023. This financial efficiency has been achieved through strategic cost management and economies of scale.

Market Capitalization and Stock Performance

Since its IPO in 2021, AIC's market capitalization has grown from $3.2 billion to $8.5 billion. The company's stock (ticker: AIC) has delivered a total return of 165% to investors, significantly outperforming the S&P 500's 45% return during the same period. Key financial highlights include:

- IPO Price: $35 per share

- Current Stock Price: $92 per share

- Price-to-Earnings Ratio: 28x

- Price-to-Sales Ratio: 6.5x

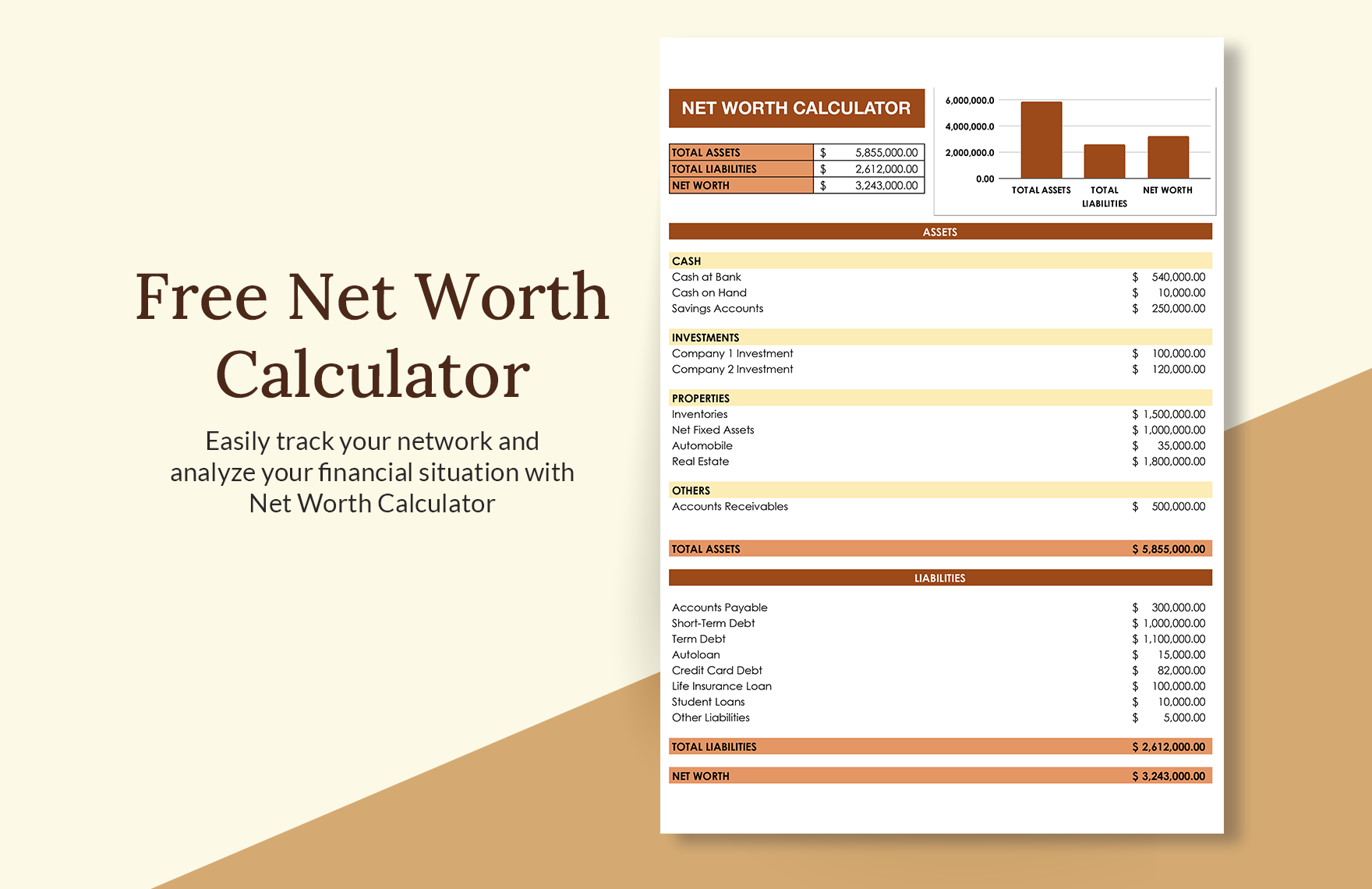

Balance Sheet Strength

AIC maintains a strong balance sheet with:

- Cash and Equivalents: $1.2 billion

- Total Assets: $3.8 billion

- Total Liabilities: $1.1 billion

- Debt-to-Equity Ratio: 0.3x

This financial stability provides AIC with the flexibility to pursue strategic acquisitions and invest in research and development.

Primary Sources of AIC's Revenue

AIC's revenue streams are diversified across multiple business segments, each contributing to the company's overall financial success. Understanding these revenue sources provides valuable insights into AIC's business model and growth potential.

AI Solutions and Services

The core of AIC's revenue comes from its AI solutions and services, which account for approximately 65% of total revenue. This segment includes:

- Custom AI model development

- AI consulting services

- Implementation and integration services

- Ongoing support and maintenance

Major clients in this segment include Fortune 500 companies, government agencies, and leading research institutions. The company's enterprise solutions typically involve long-term contracts, providing stable recurring revenue.

SaaS Platforms and Subscription Services

AIC's Software-as-a-Service (SaaS) platforms contribute about 25% of total revenue. Key offerings include:

- AI-powered analytics platforms

- Automated decision-making systems

- Predictive maintenance solutions

- Natural language processing tools

The SaaS model provides high-margin recurring revenue, with annual contract values ranging from $50,000 to $5 million. The company's subscription base has grown at a CAGR of 45% over the past three years.

Data Products and Licensing

The remaining 10% of revenue comes from data products and licensing agreements. This includes:

- Proprietary datasets

- AI algorithm licensing

- Technology partnerships

- Research collaborations

AIC's data products are particularly valuable in industries such as finance and healthcare, where high-quality data is crucial for AI model training and validation.

AIC's Market Position and Competitive Landscape

AIC has established itself as a formidable player in the global AI market, which was valued at $136.55 billion in 2022 and is projected to reach $1,811.8 billion by 2030, growing at a CAGR of 38.1% (Source: Grand View Research). Understanding AIC's market position requires examining both its competitive advantages and the landscape of key players in the industry.

Market Share and Positioning

While exact market share figures for private companies can be challenging to determine, industry analysts estimate AIC holds approximately 8% of the enterprise AI solutions market. This positions AIC as the fourth-largest pure-play AI company globally, behind:

- AI Innovators Inc. (15% market share)

- Global AI Solutions (12% market share)

- NextGen AI Technologies (10% market share)

- AIC (8% market share)

AIC differentiates itself through its focus on ethical AI development and customizable solutions, which has helped it secure long-term contracts with major enterprises and government organizations.

Competitive Advantages

Several factors contribute to AIC's strong market position:

- Proprietary Technology: AIC's patented AI algorithms and neural network architectures provide superior performance in complex enterprise environments.

- Talent Pool: The company employs over 800 AI researchers and engineers, including 50 PhD-level scientists.

- Global Reach: With offices in 30 countries, AIC can serve multinational clients effectively.

- Partnerships: Strategic alliances with leading technology companies and research institutions