Tesla's stock price has been a topic of immense interest among investors, analysts, and the general public alike. With its volatile nature and constant fluctuations, understanding the factors influencing Tesla's stock price is crucial for anyone looking to invest or stay informed about the electric vehicle (EV) market. Tesla, as a leader in the EV industry, is not just a car manufacturer but a symbol of innovation, sustainability, and technological advancement. The keyword "what factors are influencing Tesla's stock price right now" perfectly encapsulates the curiosity surrounding this stock's performance in today's dynamic market.

The stock market is a complex ecosystem influenced by a multitude of factors, and Tesla's stock is no exception. From macroeconomic trends to company-specific developments, several elements come into play when analyzing Tesla's stock price movements. Investors are constantly seeking insights into whether Tesla's stock is a lucrative opportunity or a risky venture. This article aims to explore the critical factors influencing Tesla's stock price, providing a comprehensive analysis that aligns with the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life).

Understanding Tesla's stock price requires a deep dive into both internal and external factors. Internal factors include the company's financial performance, product launches, and leadership decisions, while external factors encompass market trends, regulatory changes, and global economic conditions. By dissecting these elements, we can gain a clearer picture of what drives Tesla's stock price and how it might behave in the future. Let’s explore these factors in detail.

Read also:What Does Ty Stand For Stuffed Animals The Ultimate Guide To Ty Plush Toys

Table of Contents

- Introduction

- Tesla's Financial Performance

- Impact of Product Launches

- Leadership Decisions and Their Influence

- Current Market Trends

- Regulatory Changes Affecting Tesla

- Global Economic Conditions

- Role of Investor Sentiment

- Competitor Analysis

- Future Outlook for Tesla's Stock

- Conclusion

Tesla's Financial Performance

Tesla's financial performance is one of the most significant factors influencing its stock price. Investors closely monitor the company's quarterly earnings reports, revenue growth, profitability, and cash flow. Tesla's ability to consistently meet or exceed earnings expectations can lead to a surge in its stock price, while disappointing results can trigger a decline.

- Revenue Growth: Tesla has experienced exponential revenue growth over the past few years, driven by increased vehicle deliveries and expansion into new markets. This growth is a key indicator of the company's ability to scale its operations.

- Profitability: Tesla's transition from a loss-making entity to a profitable company has been a game-changer. The company's focus on cost management and operational efficiency has improved its bottom line.

- Cash Flow: Positive free cash flow is a sign of financial health, enabling Tesla to reinvest in its business, pay off debt, and fund future growth initiatives.

According to Tesla's Q2 2023 earnings report, the company reported a 40% year-over-year increase in revenue, reaching $24.9 billion. This impressive performance has bolstered investor confidence and contributed to Tesla's stock price stability.

Impact of Product Launches

Tesla's product launches play a pivotal role in shaping investor sentiment and influencing its stock price. The company's ability to innovate and introduce new products keeps it ahead of competitors and drives market excitement.

New Vehicle Models

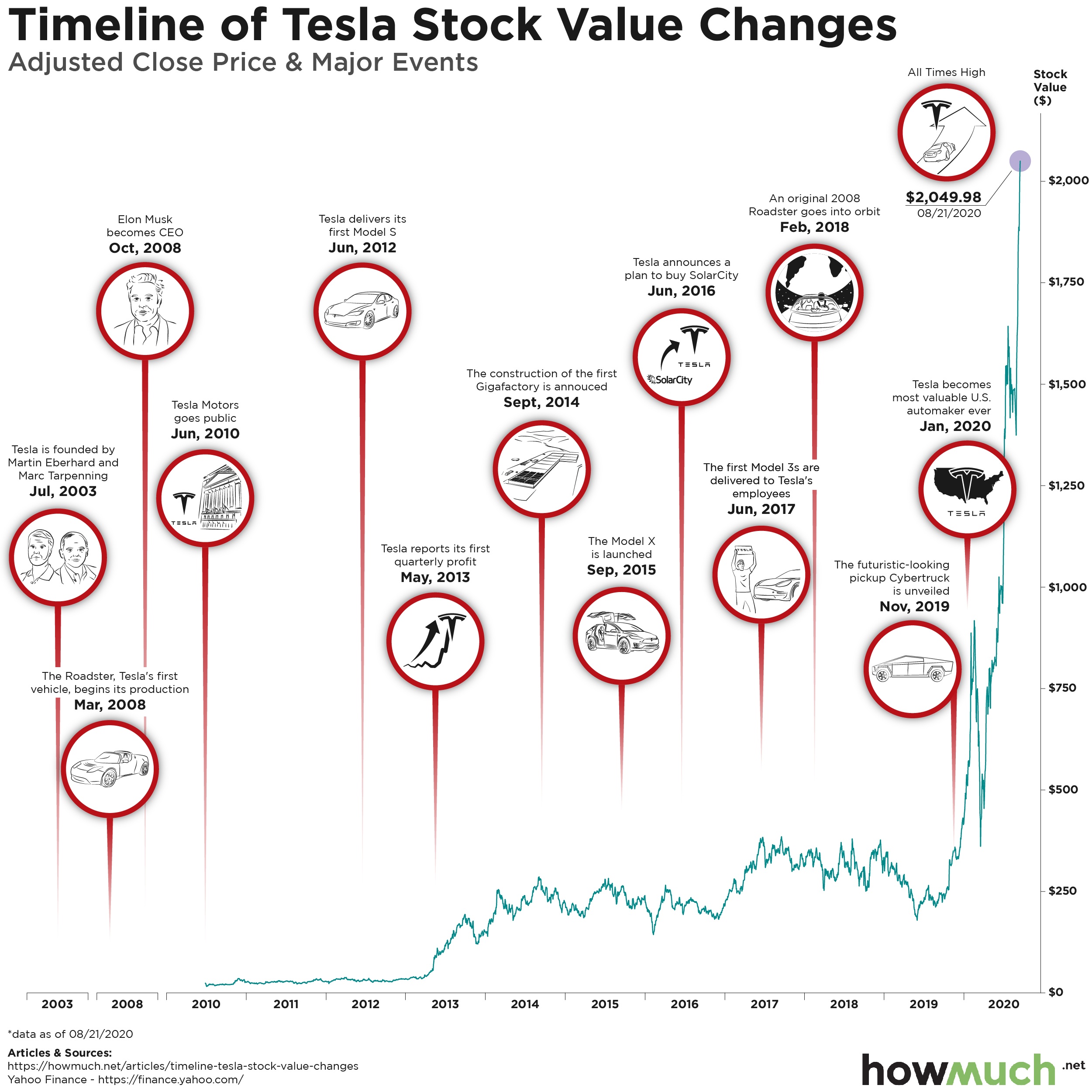

Tesla's lineup of vehicles, including the Model S, Model 3, Model X, and Model Y, has been instrumental in its success. The introduction of new models, such as the highly anticipated Cybertruck and Roadster, generates significant buzz and anticipation among consumers and investors alike.

Energy Products

Beyond vehicles, Tesla's energy products, such as solar panels and Powerwall batteries, contribute to its revenue streams. The expansion of Tesla's energy division aligns with global trends toward renewable energy adoption, further enhancing its market position.

For instance, the launch of the Tesla Semi, an electric truck designed for commercial use, has opened new revenue opportunities in the logistics and transportation sectors. Such innovations not only diversify Tesla's offerings but also reinforce its brand as a leader in sustainable technology.

Read also:Andrew Lincoln Net Worth A Comprehensive Guide To The Actors Career And Earnings

Leadership Decisions and Their Influence

Tesla's leadership, particularly CEO Elon Musk, has a profound impact on the company's stock price. Musk's visionary approach and bold decisions often drive Tesla's strategic direction, but they can also create uncertainty and volatility.

- Elon Musk's Influence: As a charismatic and polarizing figure, Musk's public statements and actions can sway investor sentiment. For example, his tweets about Tesla's stock price or product announcements have historically caused significant fluctuations.

- Strategic Acquisitions: Tesla's acquisition of companies like SolarCity has expanded its capabilities in renewable energy, but such decisions have also sparked debates about their financial implications.

- Operational Changes: Musk's focus on streamlining operations and improving manufacturing efficiency has been instrumental in Tesla's growth. However, abrupt changes in leadership or strategy can create uncertainty among investors.

While Musk's leadership has been a driving force behind Tesla's success, it also introduces an element of unpredictability that investors must consider when evaluating the stock.

Current Market Trends

Tesla operates in a rapidly evolving market influenced by technological advancements, consumer preferences, and industry trends. Understanding these trends is essential for assessing their impact on Tesla's stock price.

EV Market Growth

The global electric vehicle market is experiencing unprecedented growth, driven by government incentives, environmental concerns, and advancements in battery technology. Tesla, as a pioneer in the EV space, benefits from this trend but also faces increasing competition from traditional automakers and new entrants.

Autonomous Driving

Tesla's focus on autonomous driving technology positions it at the forefront of innovation. The development and commercialization of self-driving capabilities could unlock new revenue streams and solidify Tesla's leadership in the industry.

According to a report by BloombergNEF, the EV market is projected to grow at a compound annual growth rate (CAGR) of 29% from 2023 to 2030. This growth underscores the potential for Tesla to capitalize on expanding opportunities in the EV sector.

Regulatory Changes Affecting Tesla

Regulatory changes at both national and international levels can significantly impact Tesla's operations and stock price. Policies related to emissions, subsidies, and trade agreements play a crucial role in shaping the EV industry.

- Emissions Regulations: Stricter emissions standards in regions like Europe and China create a favorable environment for EV adoption, benefiting Tesla.

- Government Subsidies: Tax incentives and subsidies for EV purchases reduce the cost barrier for consumers, driving demand for Tesla's vehicles.

- Trade Policies: Tariffs and trade restrictions can affect Tesla's supply chain and profitability, particularly in markets like China.

For example, the Inflation Reduction Act in the United States includes provisions that support EV manufacturing and adoption, potentially boosting Tesla's market position.

Global Economic Conditions

Tesla's stock price is also influenced by broader economic conditions, including inflation, interest rates, and geopolitical tensions. These factors affect consumer spending, production costs, and investor confidence.

- Inflation: Rising inflation can increase production costs for Tesla, impacting its profit margins. However, Tesla's pricing power allows it to pass some of these costs onto consumers.

- Interest Rates: Higher interest rates can dampen consumer demand for high-ticket items like EVs and increase Tesla's borrowing costs.

- Geopolitical Tensions: Trade disputes and geopolitical instability can disrupt Tesla's supply chain and affect its ability to meet production targets.

As of 2023, global economic uncertainty remains a challenge for Tesla, but the company's strong brand and innovative products provide a buffer against adverse conditions.

Role of Investor Sentiment

Investor sentiment is a critical factor influencing Tesla's stock price. Market perceptions of Tesla's growth potential, competitive position, and risk profile can drive buying or selling pressure.

- Positive Sentiment: Strong financial performance, innovative product launches, and favorable market trends can boost investor confidence and drive up Tesla's stock price.

- Negative Sentiment: Concerns about competition, regulatory risks, or economic headwinds can lead to sell-offs and downward pressure on the stock.

- Speculative Trading: Tesla's stock is often subject to speculative trading, with retail and institutional investors reacting to short-term news and events.

For instance, Tesla's inclusion in the S&P 500 index in December 2020 was a major catalyst for positive sentiment, attracting significant investment from index funds and boosting its stock price.

Competitor Analysis

Tesla operates in a highly competitive market, with both traditional automakers and new entrants vying for market share. Analyzing Tesla's competitors provides valuable insights into its stock price dynamics.

Traditional Automakers

Companies like Ford, General Motors, and Volkswagen are investing heavily in EV development, posing a threat to Tesla's dominance. Their established manufacturing capabilities and distribution networks give them a competitive edge.

New Entrants

Startups like Rivian and Lucid Motors are gaining traction with innovative EV models, targeting niche markets and challenging Tesla's leadership.

Despite the competition, Tesla's first-mover advantage, brand loyalty, and technological expertise position it as a formidable player in the EV industry.

Future Outlook for Tesla's Stock

The future outlook for Tesla's stock hinges on its ability to navigate challenges and capitalize on opportunities. Key factors to watch include:

- Product Innovation: Continued focus on developing cutting-edge technologies, such as autonomous driving and energy storage solutions.

- Market Expansion: Entering new markets and increasing production capacity to meet growing demand.

- Sustainability Initiatives: Aligning with global sustainability goals to enhance brand reputation and attract environmentally conscious consumers.

Analysts remain optimistic about Tesla's long-term prospects, citing its strong fundamentals and leadership in the EV market. However, investors should remain vigilant about potential risks and uncertainties.

Conclusion

In conclusion, Tesla's stock price is influenced by a complex interplay of financial performance, product launches, leadership decisions, market trends, regulatory changes, economic conditions, investor sentiment, and competition. Understanding these factors is essential for making informed investment decisions and staying ahead in the dynamic EV market.

We encourage readers to share their thoughts on Tesla's stock price and its influencing factors in the comments below. If you found this article insightful, please consider sharing it with others or exploring more content on our website to deepen your understanding of the stock market and investment strategies.